tax strategies for high income earners australia

What Is A High Income Family In Australia. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

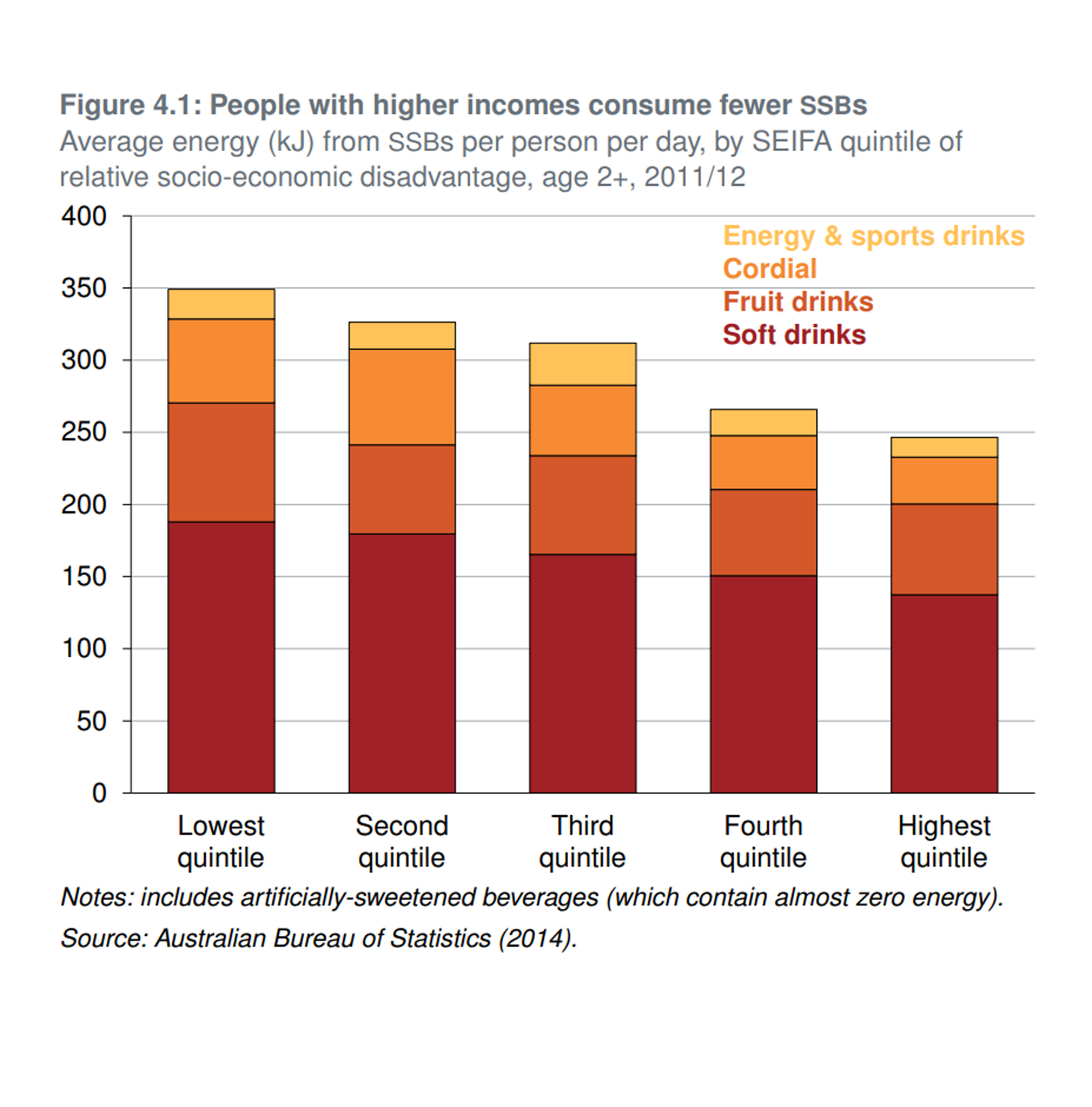

Meeting A Sweet And Sticky End Obesity And Sugar Taxes In Australia By On Dit Magazine Medium

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

. This video gives a few suggestions on how to reduce taxable income. Keeping up to date with all of your records means you can lodge your tax return as soon as possible after the end of the financial. Contact a Fidelity Advisor.

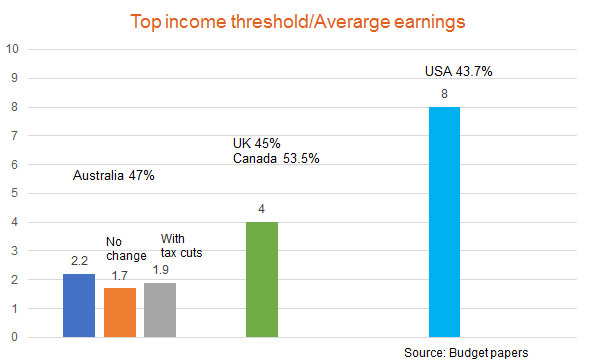

Our highest marginal income tax rate kicks in at around 2x average earnings vs about 4x in most other countries and the. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates. Get ready to lodge your tax return.

Based on the Australian Taxation Office 62000 taxpayers in the top 1 percent earned an average taxable income of 760853. Using a Discretionary Trust to reduce taxes. A tax offset of 10000 would reduce your tax payable down to.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Tax Planning Strategy 8. As a refresher for 2021 FY the individual tax rates including medicare levy are.

Dont waste your good fortune or hard work by not. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Australia overtaxes high wage income earners relatively speaking. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Tax Strategies For High Income Individuals How to reduce taxable income for high earners.

According to Australian Bureau of Statistics. If you have 100000 of assessable income for the year your tax payable would be approximately 26000. Its possible that you could.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Based on new survey data an individual earning 1200 a week or more will have a higher income than the bottom half of Australians. 4 hours agoAnd now we have the Albanese Government promising to push through the previous Liberal Governments planned tax cuts for wealthier people.

Cuts that will eliminate the 37. For taxable income levels between 180000 and 273000 the. Contact a Fidelity Advisor.

This is a tax-effective strategy because super contributions. So what are the top tax planning strategies for high income employees. Both are studying and will continue education for another 5.

Max Out Your Retirement Account.

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian

Tax Minimisation Strategies For High Income Earners

Tax Strategies For High Income Earners 2022 Youtube

How To Pay Less Taxes For High Income Earners Wealth Safe

![]()

Tax Strategies Corporations And Trusts The Live Life Project

How Do High Income Earners Reduce Taxes In Australia

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

High Income Earners To Reap 88 Of Coalition S Tax Cuts By 2021 22 R Australia

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Strategies For High Income Earners 2022 Youtube

Tax Reform Welcome But More To Do Betashares

How Do High Income Earners Reduce Taxes In Australia

How Do High Income Earners Reduce Taxes In Australia

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

How To Pay Less Taxes For High Income Earners Wealth Safe

The Australia Institute 2019 Budget Wrap By The Australia Institute Medium

What Is Considered A High Income Earner In Australia Ictsd Org